Analyzing Financial Performance of Biggest Gaming Companies in 2022

The beginning of March is a time of financial summaries in the gaming industry. Major companies listed on the world's stock exchanges have just released their results for Q4 2022, and we analyze the data.

3

Data from reports of large industry companies allows to asses their performance in 2022 and see which games were most profitable, and try to predict what challenges lay ahead in the near future. In this article, we will briefly analyze the performance of seven companies. Namely, Activision Blizzard, Electronic Arts, Take-Two Interactive, Embracer Group, Square Enix, Ubisoft and... Roblox Corporation. The latter may seem surprising among traditional publishers. As the data shows, however, Roblox is big enough to compete with the typical industry giants.

What data are we talking about specifically? We will look at the total revenues in 2022, their breakdown into individual platforms, the accounts of profits and losses, and hence determine the biggest financial hits of the past year. We will also look at how the share prices of companies have changed, and try to establish how much one could gain (or lose) by buying shares in each of them.

And where are the others?

At the time of writing these words, we are still waiting for the last quarterly financial summary of CD Projekt RED. It's due to the incompleteness of data for 2022 that CDPR has not been included here.

In addition, the article doesn’t include the owners of platforms and large holdings (Sony, Nintendo, Microsoft and Tencent) since they all use very different business models and conduct additional activities – from manufacturing TVs and developing office software to conducting banking activities.

Valve Corporation is another big absentee. The owner of Steam isn't listed on any stock exchange and does not publicize financial statements.

How big is each publisher?

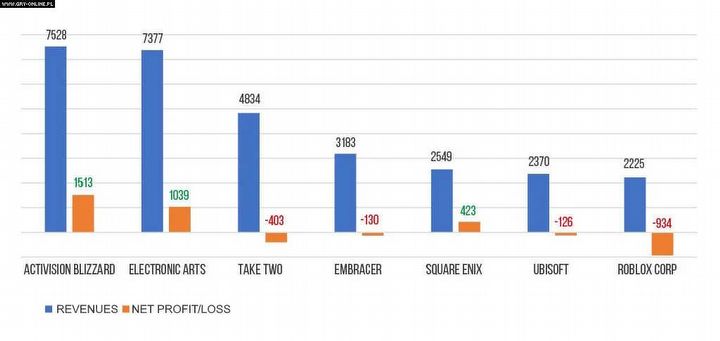

A brief glance at the comparison of revenues achieved in 2022 allows the assessment of the relative size of individual companies.

The two absolute biggest giants are Activision Blizzard and Electronic Arts, followed by Take-Two and Embracer with significantly lower results (which are still impressive).

High positions of Activision and EA should not be surprising – with such popular series as Call of Duty and FIFA, it's impossible to expect a different result. The ending looks more interesting, which shows that Roblox Corporation (a company that develops only one game) competes with companies that have many – it would seem – more profitable franchises. It's hard, for example, to believe that Ubisoft doesn't earn more on the Assassin's Creed series alone.

The chart above also shows the net profit/loss, after deducting all costs that appear in the financial statements. Although the gaming business can bring multi-billion profits, 2022 wasn't very kind to this industry. Only Activision, EA and Square Enix made profit. It should be noted here, however, that most of these results are not extreme or alarming – similar gains or losses have happened in the past. The biggest exception to this rule is Roblox, which has never recorded such a large loss before. However, this is not a reason to worry, which we will explain in a moment.

Which platforms make the most money?

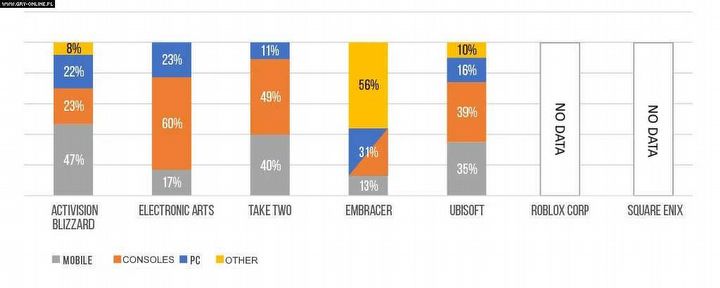

Companies from the above list make money on all major hardware platforms: PC, consoles and mobile devices. One might surmise from reports on such hits as Grand Theft Auto, the NBA series and other big titles of EA, Activision and Ubisoft, that the industry makes the biggest money from consoles and PCs. The reality, however, is not as simple.

A breakdown of revenues by platform in 2022. 8% of Activision Blizzard's other revenues include distribution and e-sports. In contrast, 56% of Embracer's main revenues include board games (36% ), entertainment (20%), and services.

Consoles and PCs are a huge part of the market and in the case of Electronic Arts, for example, these platforms provide as much as 83% of total revenues. Although we don't have specific data on Square Enix, the company only released a few Final Fantasy remasters on mobile between 2021 and 2022, so it probably also gets the most revenue from consoles and PC.

Nevertheless, the growing significance of mobile games cannot be understated at this point. In Activision, these are responsible for almost half of the revenue. Industry acquisitions in recent years are undoubtedly responsible for this state of affairs (Activision took over King, Take-Two bought Zynga, Electronic Arts Glu Mobile, and Ubisoft took over and consolidated several smaller companies), same as mobile projects created "from scratch" in parent companies.

The distribution of revenues in the Embracer group looks particularly interesting – as much as 56% comes from sources other than video games. We're talking board games (36% more than PCs and consoles combined!) and distribution of books, comics, movies and third-party games.

It's also worth noting the "Other" category in the Activision Blizzard's column. It accounts for 8% and consists of distribution (which reports do not elaborate on) and revenues from e-sports leagues: Call of Duty and Overwatch's. E-sport is undoubtedly hyped in the media, but it seems that financially – compared to traditional publishing – it's rather modest.

Which games make the most money?

Publishers are reluctant to share detailed performance of individual games. Fortunately, the comments accompanying the data allow to assess which games and series are most important to companies. The more money was generated by a given series, the more praises a report gives to it.

In the case of Activision, the number one is, of course, the Call of Duty series, but the company's owners admit that CoD shrunk compared to 2019, bringing 203 million dollars less. The fastest growing game in the series is Call of Duty Mobile – although no specific numbers were quoted, we're talking a year-on-year increase in tens of percent. King and Blizzard also recorded growth, probably due to the unflagging popularity of Candy Crush Saga and new projects: Overwatch 2 and Diablo Immortal.

On the Electronic Arts' side, the FIFA series reigns supreme, in each of its versions. Namely, these are FIFA 23, FIFA Mobile and FIFA Online (version released for Asian markets). The report claims that the latest major installment of the series is on its way to being the biggest title in the series, probably in large part thanks to the publicity generated during the 2022 Football World Cup.

Compared to FIFA, other titles (Apex Legends, The Sims 4) are only briefly mentioned. The big absentees were the Battlefield and Need for Speed series, although they were released quite recently. In the case of NFS, we're talking about a title... from December 2022.

Take-Two Interactive draws most of its revenue from three branches: 2K Games, Rockstar Games and Zynga. The first two are working on (respectively) the NBA and Grand Theft Auto series. Zynga, in turn, owns a number of mobile games, including Empires & Puzzles and Toon Blastem. These four games generate the most for Take-Two.

Other products, such as Red Dead Redemption 2, Tiny Tina's Wonderlands or the WWE series, are mentioned sporadically or not at all, suggesting that they earned less than the mobile games cited above. The lack of the mobile football game Top Eleven or Harry Potter: Puzzles & Spells, which utilizes a famous franchise, is surprising. It may also be sad that very little attention is paid to titles published by Private Division (OlliOlli World, Rollerdrome).

Embracer's owners say that the main source of growth in their company in 2022 were acquisitions. Crystal Dynamics, Perfect World, Asmodee, Dark Horse and Limited Run Games have joined their ranks, and it were the revenues from these companies that feed Embracer's profit and loss account. In the meantime, the organic growth of games and franchises owned so far has been virtually non-existent, and the report doesn't really list any major releases (maybe apart from Goat Simulator 3...). Board games, which we mentioned earlier, did exceptionally well!

In its reports, Square Enix emphasizes the revenues from Crisis Core: Final Fantasy VII Reunion, Dragon Quest Treasures and... Dragon Quest X released years ago. The management points out that in 2022 they had no exceptionally profitable releases, hence the sale of games is more than 10% below 2021 results. To complete the picture, it's worth mentioning that well over half of Square Enix's revenues are generated in Japan, and one of the most important sectors of the company is... a network of arcade salons. Of course, these are also located in Japan and account for about 16% of the company's revenues.

In Ubisoft the Assassin's Creed series is what it's all about. The company reported unflagging interest in three titles (and revenues from them). These were Origins, Odyssey and Valhalla. Tom Clancy's Rainbow Six Siege is also a significant product, which reportedly generated satisfactory revenue for the entirety of last year.

Of course, Roblox Corp. is focused on a single product, eponymous at that. As we have seen above, although this company generates considerable revenue, it was and still is in the red. Roblox took the opportunity presented by the pandemic and increased the number of active users and the resulting revenue, but both of these metrics stopped growing noticeably in 2022 and it seems that the company has stagnated since. This could spell trouble for the company in the near future, although the balance sheet shows that Roblox Corp has the round sum of three billion dollars to spend on further development. This likely means that a way out of this stalemate is on the cards.

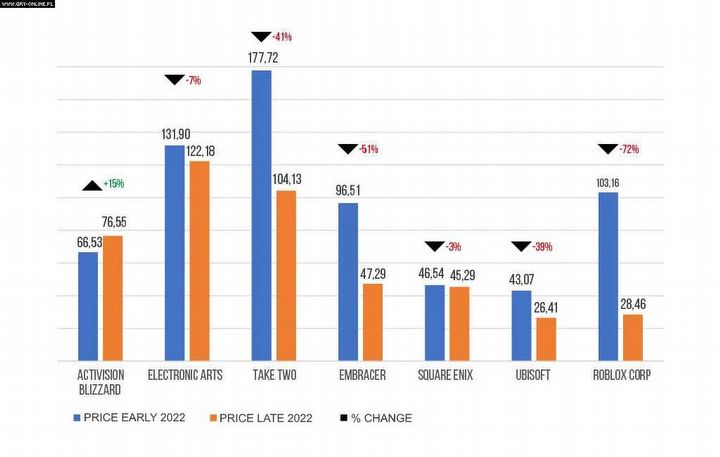

How have share prices of gaming companies changed in 2022?

Last year was not very kind to investors, especially those who bet on tech companies. Inflation, interest rate hikes and the economic effects of Russia's invasion of Ukraine have caused stock exchange markets in the US and Europe to record significant declines. Nasdaq, which brings together technology companies, recorded a decline of 33%. Thus, regardless of the achieved financial results, the above-mentioned external factors led to a drop in the share prices of almost all gaming companies analyzed here.

The undoubted winner here was Activision Blizzard, which was the only one to record an increase. As we saw earlier, the financial health of the company headed by Bobby Kotick is exceptionally decent, which would justify the increase in price. In addition, the news of a potential acquisition by Microsoft further improved the ratings.

The relatively low decline in EA's share prices is due to the good results between April 2021 – March 2022, which gave investors hope for profits for the rest of 2022. Square Enix's share price was also aided by the good results from the previous financial year and the news of the relinquishing of Crystal Dynamics, Eidos Montreal and Square Enix Montreal studios, warmly received by the investors.

The biggest loser turned out to be Robloxwhose price seemed to be significantly overstated during the pandemic. In November 2021, one share cost an astronomical amount of $134.72 – no other gaming company has ever recorded such value. So in 2022, there was a correction that brought the stock price back to a more reasonable level.

What will the future bring?

It's difficult to estimate, especially when it comes to the activities of listed companies. Based on industry news and information contained in quarterly reports, however, we can determine which events and decisions will have the greatest impact on the future of gaming giants. Below, you will find the most important of them.

The fate of Activision will be decided by the potential acquisition by Microsoft. It's impossible to predict all the consequences of this move, but if the transaction goes through, all stakeholders will feel them: consumers, employees and shareholders. The former will definitely appreciate the likely presence of Activision games in Game Pass, streaming services and on Nintendo devices.

Employees will most likely face restructuring and consolidation of studios, although official documents on the acquisition state that Microsoft will provide the same, or better, working conditions for the first 12 months after the acquisition. Shareholders, on the other hand, can expect an increase in share prices – Activision currently costs $77 per share, and when the transaction is confirmed, this value will approach $95 a share, i.e. the value of Microsoft's share.

But back to games – Activision will probably turn out to be the first industry to focus the majority of its efforts on mobile. This is indicated by the rapid growth of Call of Duty Mobile, the unflagging popularity of Diablo Immortal, and the fact that Activision still has not found a way to support PC gamers in China after terminating its contract with NetEase – a local partner for games such as World of Warcraft and Overwatch.

Trying to determine in which direction the Call of Duty series is headed is puzzling. It has been an "everything for everyone" kind of arrangement for some time now – it offers single-player, co-op and PvP gameplay on all major hardware platforms, in both free-to-play and premium models. After the release of Warzone, Activision stopped chasing the competitive Fortnite and can now try to pioneer its own way of developing the brand. What comes to mind is entering Nintendo platforms and – perhaps – preparing a separate game for younger audiences.

Electronic Arts is looking at a year of major rebranding of its sports games. FIFA 23 was the last major installment of the game under the license of FIFA, and in 2023 we will get a soccer game called EA Sports FC. However, many people may still be looking for the word "FIFA" on shelves and in stores, so regardless of the quality of the new release, the change of the title after almost three decades may have a noticeable impact on the bottom line.

It's worth recalling that Activision once faced a similar challenge. The company considered separating the Call of Duty and Modern Warfare brands in 2009. Ultimately, this did not happen, and the recent successes of the new versions of Modern Warfare probably showed that it was the right choice.

An important element of the latest report of EA is also lowering the financial forecasts. The company cools expectations down and forecasts results below those predicted three months ago. This is due to the postponement of Star Wars: Jedi Survivor and the cancellation of two mobile projects: Apex Mobile and Battlefield Mobile.

Take-Two will now focus on reducing costs and seeking synergies. During a conversation with investors, the company's management stated that they see potential savings in the teams responsible for general management and publishing. This is an attempt to balance the business after the acquisition of Zynga – although the mobile developer supplies Take Two's portfolio with popular games, it was this transaction that increased the company's operating costs by 120%. Therefore, the management board cooled investors' expectations and announced that a net loss would probably also be recorded in the current Q1 2023.

Embracer will focus on optimizing and increasing the effectiveness of its mobile projects and look for synergies between the company's divisions. Embracer is the only company with a broad entertainment ecosystem that encompasses video games, board games, comics, books and movies, so it would definitely make sense to attempt that. Admittedly, this process has been going on for some time, given the acquisition of the rights to Lord of the Rings and the cooperation with Amazon based on the Tomb Raider franchise. From purely gaming releases, the company has high hopes for the imminent debut of Dead Island 2.

Square Enix has explicitly stated that it won't share any detailed forecasts. The only thing we got was the vague statement that the company will adjust to changing realities and build the foundations for sustainable growth based on the free-to-play model, microtransactions and subscriptions. Square Enix will probably also pay more attention to mobile devices.

Ubisoft is facing a difficult year, given the words of the CEO, Yves Guillemot, who asked employees to spend company money wisely, which caused quite the stir among the staff. Recent reports mainly talk about postponing releases and there is no indication that Ubisoft will soon deliver something revolutionary. This suggests an even stronger focus on the profitable Assassin's Creed and Rainbow Six Siege, as well as... Mario + Rabbids: Sparks of Hope, which management says has a good chance of selling well in the long run.

Roblox will face two challenges – turning bigger engagement of users into money and trying to get older player on board. A Q&A session between the company's management and shareholders reveals that Roblox is getting more and more content intended for older players from third-party developers, as exemplified by the horror game DOORS available in the world of Roblox. At the time of writing this, DOORS had over 200,000 active players, roughly half of what games like PUBG or Apex Legends could boast. The management also emphasized that it will be more willing to experiment with advertising and product placement, similar to the Gucci campaign in 2021.

The current situation of the gaming industry is unprecedented. In 2022, it recorded the first drop in global revenue in modern history, and development studios are increasingly competing with other media for users' attention. In addition, the gaming business is so large that geopolitical events and macroeconomic trends increasingly affect the revenues of companies and the content of games that come to us. In order to better understand the reality of this industry, we will be watching future financial reports with great attention to try and extract from them the info that's missing from official announcements and messages. In today's avalanche of information, clarity is needed more than ever.

- Players choose remakes over remasters, spending more to relive the classics, although there are few exceptions

- 72% of game developers think Steam is a monopoly. However, they have one good reason to keep using it

- „They don't even notice that prices have gone up.” Analyst on who is really buying AAA games today

3

Latest News

- Huge Marvel Adventures mod now with new superheroes, including Sentry

- Butcher's Summit, an impressive free diselpunk FPS, has been released

- Free FPS on Half Life engine gets big update

- On February 3, gaming history could change forever. Red Dead Redemption 2 one step away from a major achievement

- This is not the RPG you expected. Crimson Desert abandons the key elements of the genre, going for original solutions